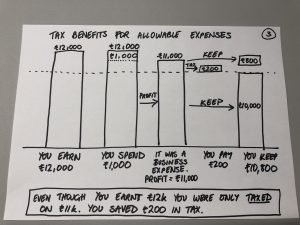

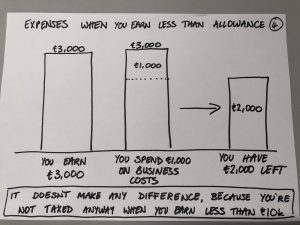

My 16-yr-old son is about to become self-employed. This is my attempt to explain why we need to keep receipts for expenses, and what impact it will have on the tax he pays.

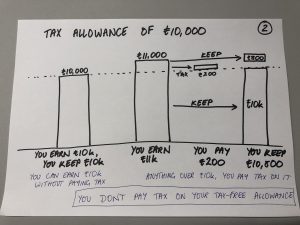

Note that the UK tax allowance is currently £11,500 (see here), but I made it £10,000 to keep the sums simple.